India aims “Funding the un-Funded” through Rs 20000 Crores MUDRA Bank. Culturally, India is a land of Merchants/ Entrepreneurs; it’s in blood of many individuals and in dreams of millions to be successful Business tycoon. Today in India, 5.75 cores (57.5 millions) Small Un-organized Entrepreneurs gives employment to 12+ crores (120+ millions) people and over hyped White collar Black Suit type businessmen only contributes to just 1.25 crores (12.5 millions) employment!

These 5 crore 75 lakh (57.5 millions) self-employed but “Neglected Heroes” in small scale Entrepreneurs with funds of Rs 11 lakh crore, an average per unit debt of merely Rs 17,000 (~ $285), gives employment to 12 crore (120 millions) other Indians.

Irony, in spite of creating such huge employment, only 4% of Small Entrepreneurs gets loans from Banks due to lack of Mortgage/Credit backup/Trust facility, rest have to depend on Saukars (informal money lenders) who exploits them with heavy interest upto 25-30%!

In other words, all Indian Banks gives their 96 % of loans to media hyped, rich businessmen with front page cover stories, who actually contribute just one-tenth comparing to small scale in terms of number of actual Employment in country!

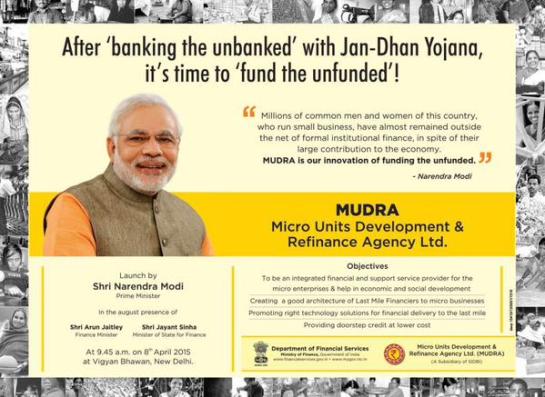

To remove this mismatch and burden on hard working poor honest Entrepreneurs, Indian PM Mr. Narednra Modi, as he promised during his election campaign, launched new MUDRA Bank (Micro Units Development and Refinance Agency). “Mudra” in Sanskrit means Coins or Money.

In India, loans for small business has short from targeted of about Rs. 5 lakh crores (~$80 billion), this gap will be filled by MUDRA Bank.

MUDRA bank has corpus of Rs. 20000 crores (~$3.3 billions) and credit guarantee corpus of Rs 3000 Crores (~ $500 millions).

How MUDRA Bank will work:

After identifying the needy via various existing Government Microfinance agencies, MUDRA Bank will give low interest loans upto Rs. 10 lakh (~ $166666) in three categories as per the customer needs:

-

Shishu (A) category – loans up to Rs 50,000 (~$850)

-

Kishor (B) category – from Rs 50,000 and up to Rs 5 lakh (~$8500)

-

Tarun (C) category – from Rs 5 lakh up to Rs 10 lakh (~$166666)

Additionally, bank will give MUDRA card to customer for drawing limited small dose of cash credit facility in case of crisis, upto say Rs. 10 to 15000 (~$1200).

MUDRA bank will give boost to common man’s dreams and help them to start business with low interest loans, also help giving self-employment to millions!

Teaser (in Hindi) – MUDRA Bank scheme

PM Narendra Modi explaining importance of MUDRA Bank

-

Says Smalls scale contributes more to society than big houses

-

Not happy to see white collar gets more attention than hard working poor street entrepreneurs, who are giving more employment

Wall papers: MUDRA Bank launch 8-April-2015

Image credit: MUDRA bank, PM Narendra Modi Website, Twitter account, PM India website.

Image credit: MUDRA bank, PM Narendra Modi Website, Twitter account, PM India website.

Sources: Twitter, Google search, youtube, PM Narendra modi official website, Govt of India, and all links mentioned in the post.

in which way common bissnesman gain by pm,s mudra bank

LikeLike

Thank you for visit..Please see link below how MUDRA scheme is working for Small businessmen (unorganized sector)…

http://www.narendramodi.in/text-of-pm-s-address-at-the-inauguration-of-mega-credit-camp-under-pradhan-mantri-mudra-yojana-at-dumka-362451

LikeLike

Pingback: ~ Demonetization in India: Complete story, Cause, Concerns and Consequences | GLOBAL INDIAN BLOG